MANUFACTURING INDEX REACHES RECORD HIGH

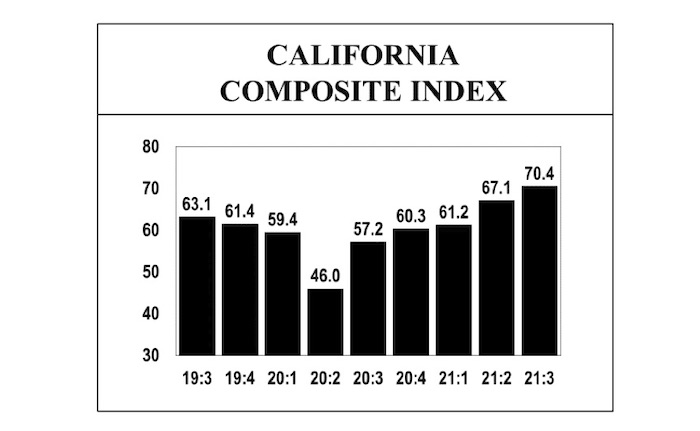

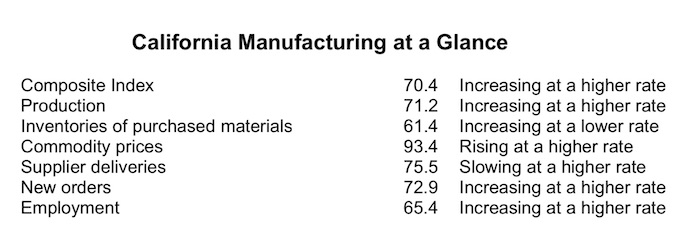

ORANGE, CA — Based on a survey of purchasing managers, the California Composite Index, measuring overall manufacturing activity in the state, increased from 67.1 in the second quarter to 70.4 in the third quarter. This indicates that the manufacturing sector is expected to grow at the fastest rate since the survey started.

“The California Composite Index is expected to reach a level over 70 for the first time. This indicates that the recovery of the California manufacturing sector is getting stronger and is surpassing that of services” said Dr. Raymond Sfeir, director of the purchasing managers’ survey. Production, new orders, and employment are expected to increase in the third quarter.

The commodity price index is expected to reach a level over 90 for the first time, indicating a fast increase in these prices due to high demand. The purchasing managers in most industries are having major difficulties filling job openings and securing raw materials.

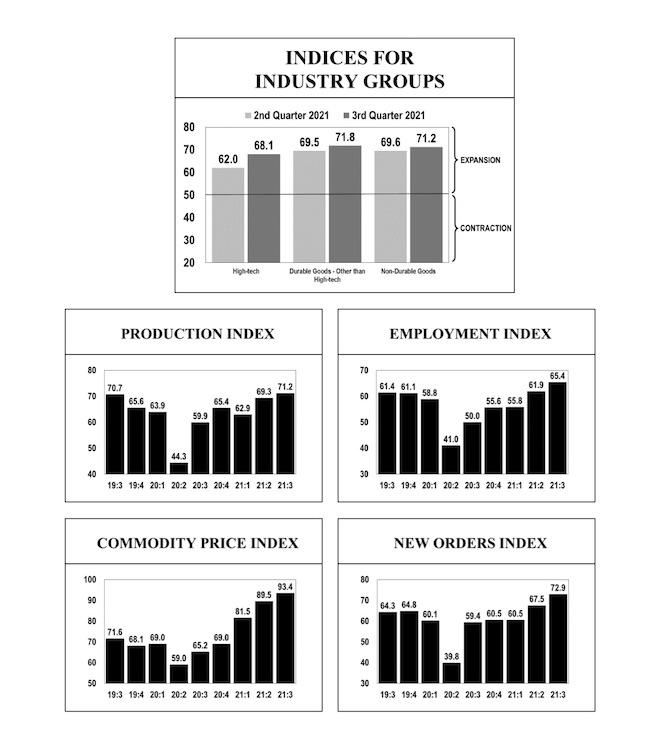

The index for the non-durable goods industries increased from 69.6 in the second

quarter to 71.2 in the third quarter, indicating an expansion in these industries in the third quarter. Inventories of purchased materials, new orders and employment are expected to increase at a higher rate in the third quarter. The commodity price index has reached a new high at 93.5. Supplier deliveries are expected to be slowing at a higher rate with an index of 78.3, a new high.

The high-tech industries include the following: Computer & Electronic Products, and Aerospace Products & Parts. The high-tech industries currently employ about 359,000 employees, amounting to 28.6% of total manufacturing employment in the state. The index for the high-tech industries increased from 62.0 in the second quarter to 68.1 in the third quarter, indicating a higher growth rate in the third quarter compared to the second quarter. Production, new orders and employment are expected to grow at a higher rate. Commodity prices are expected to rise at a higher rate with the index standing at 94.9, even higher than that of the non-durable goods industries.

The index for the durable goods industries other than high-tech increased from 69.5 in the second quarter to 71.8 in the second quarter, indicating a higher growth rate in these industries. New orders and employment are expected to increase at a higher rate in the third quarter. Commodity prices are expected to rise at a higher rate with an index of 92.4.

Comments by the Purchasing Managers

We are seeing unprecedented increases in raw material costs in the food industry. Corn is the main feed for livestock and the futures of corn are astronomical. Labor remains a huge issue as well, we cannot source enough labor for production needs. (Food)

There is no one to hire! (Beverage & Tobacco Products)

I have been in this chair for over 20 years. Never experienced a period of cost increases like right now. Seems like everything overseas and domestic has a price hike. Business remains very strong. Still faced with capacity issues in our domestic plants because we cannot staff properly. When will people want to work again? We have no choice…we are passing along the price increases. It is not easy but the major retailers we do business with are facing the same from everyone. Gaining traction with price increases. (Textile Mill Products)

Freight is 10xs what it was 2 years ago. (Apparel)

Hyperinflation is here. There is no transitory inflation. M2 + labor up + warehouse demand causes massive increase in costs. Freight is a mess. (Paper)

The paper mills are out of many grades. We are having to find similar papers on many jobs in order to produce the order. The mills are playing catch up, they are very backed up in production. (Printing & Related Support Activities)

Business remains very strong. Major capital expansion projects are taking place at all production sites to support of increased demand. Raw material costs are going up at record rates (chemicals & packaging). Logistics are also impacting our cost significantly. (Chemicals)

We are struggling to find potential employees to even show up for interviews. We have enlisted multiple temp agencies to try and help but the desire to work seems to be low on the list of people’s priorities right now. I hear the same struggle from my Vendor’s as well. (Plastics & Rubber Products)

Even though lumber prices are starting to dip slightly, it is still getting more difficult to get supplies due to the effect that Covid has had on the raw material shortage & lack of people seeking employment. (Wood Products)

We’re experiencing a big shortage of materials, and employees. (Nonmetallic Mineral Products)

Higher shipping cost have hindered our customers buying. Lack of replacement parts has hindered production as well. (Primary Metals)

Many customers were forced to close during COVID. When they finally reopened, they realized they were behind in their orders & inventory. This caused a mass ordering to occur to make up for lost time. We are also seeing an increase in ordering due to less competitors. We have been working overtime for the last two months and anticipate this to continue through at least the 3rd quarter of this year maybe until the end of the year to keep up with continually increasing demand. The workforce is still slim pickings until unemployment ends. (Fabricated Metal Products)

We are purchasing move aggressively than last year. Just In Time is out the window. Better to have inventory and be able to run than lose opportunity. (Machinery)

Supply chains have been interrupted! Items that typically take 3-5 days to get delivered at time of procurement, are now taking 45-75+ days. Very challenging and uncharted territories. (Computer & Electronic Products)

For context, we are a worldwide electrical distributor. Like most, we are experiencing supply issues with most manufacturers we deal with. After 10 years of little or no inflation where manufacturers would guarantee pricing for a minimum of six months and typically a year, we are now getting price increases monthly. The worst with steel and copper. We do expect steel prices to start returning to normal at the end of the 4th quarter. Copper we think will remain at elevated levels into the foreseeable future. (Electrical Equipment, Appliance & Components)

Shipping is very slow – every mode of transportation is delayed. (Transportation Equipment)

The Home Furnishings Industry has been experiencing a BOOM in business. Incoming business is great… Raw Materials however are tough to get and driving cost up! (Furniture & Related Products)

We work for the state and federal government, but they are pushing back projects so we are transitioning toward the private sector. We have a 2-day quoting clause, because prices rise so dramatically. We are utilizing low interest rates to accelerate. Lumber prices are making us think there will be a housing crash. (Miscellaneous)

Components to watch for this quarter are: rubber materials, molding resins. Lead-times are increasing drastically as well as prices. Commercial aerospace is expected to reach its peak this summer and suppliers are responding very slow with order placement/confirming orders. (Aerospace Products & Parts)