Los Angeles Regional Food Bank, Alliance for Children’s Rights, Golden State Opportunity, and Economic Security Project Action rally to expand the Child Tax Credit by year end.

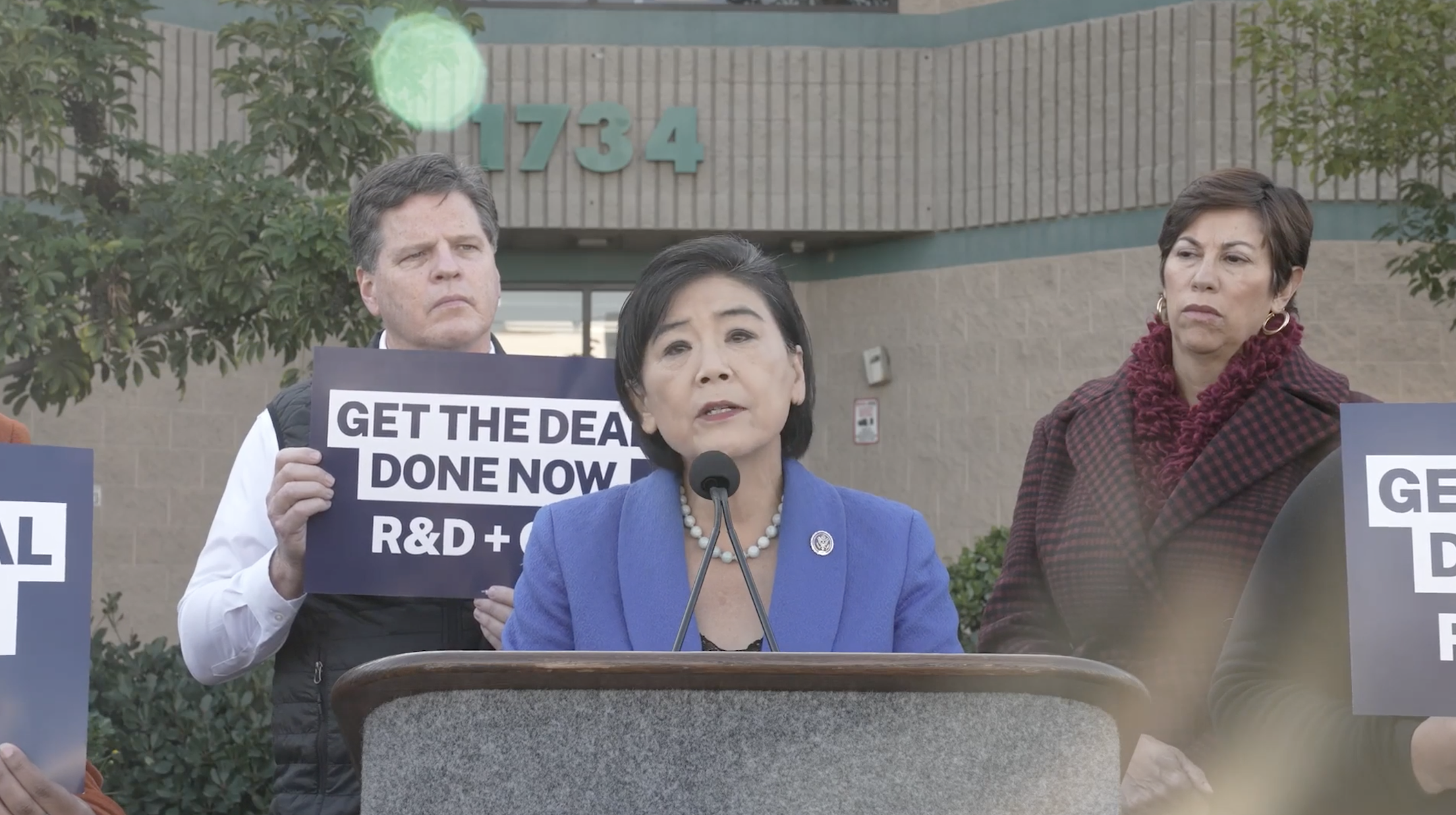

Los Angeles, CA – Today, the Los Angeles Regional Food Bank, the Alliance for Children’s Rights, Golden State Opportunity, and Economic Security Project Action stood alongside Representative Judy Chu in demanding that House and Senate leadership in Washington, D.C. oppose any new tax breaks for wealthy corporations until Capitol Hill restores the expanded monthly Child Tax Credit through the annual congressional budgetary process.

During a press conference at the Los Angeles Regional Food Bank that included Michael Flood, President and CEO of the Los Angeles Regional Food Bank, Barbara Facher, Director of the Health Teen Families Program at the Alliance for Children’s Rights, and Monica Lazo, Policy Manager at Golden State Opportunity, Representative Chu said:

“[The CTC] was among the most ambitious and impactful anti-poverty programs in our country’s history, and I am here to say that we cannot allow the CTC to become just a part of history. We need to continue it into the future. The expanded CTC expired at the end of 2021, pushing millions of children back into poverty and leaving countless families without the economic security they needed. That is why Congress has to take action before the end of the year to extend the CTC and restore these crucial benefits. I am proud that House Democrats of all stripes have joined together in very strong unity to say, ‘No tax cuts for businesses without extending the Child Tax Credit.’ We have to have a nationwide outcry about this.”

“The Child Tax Credit is a critical component to lifting families with children out of poverty, added Michael Flood, “and we strongly support the inclusion of the CTC in this year’s budget going forward. We’re solidly behind this provision.”

The American Rescue Plan’s monthly Child Tax Credit slashed childhood poverty by unprecedented margins while dramatically reducing food insecurity, revitalizing rural communities, and empowering individuals to pursue meaningful work. According to the Census Bureau, child poverty across the nation dropped by roughly one half while the Child Tax Credit was in effect, keeping an estimated 9.6 million people out of hardship.

“I, a single parent, was unemployed for five months before I was able to find work during the pandemic, so these checks were a godsend,” said Monica Lazo. “We found something that works, but we’re here again pleading to Congress to reinstate the CTC. Families cannot continue to struggle. This is something that needs to be done now.”

Barbara Facher said, “The expanded Child Tax Credit raised approximately 2.1 million children out of poverty, a more than 40% reduction in childhood poverty. As one of my clients said to me, ‘I was able to breathe a little easier. I didn’t have to make that choice each month between diapers and paying all of my rent.’ We have seen what the expanded Child Tax Credit can do to alleviate some disparities and ensure that children, at the very least, don’t go to bed hungry. Knowing this, how can it even be a question whether or not to make the expanded Child Tax Credit permanent. We should and we must continue this life-saving measure for the children in our communities.”

According to the Center for Budget and Policy Priorities, the expanded Child Tax Credit would lift nearly 600,000 from poverty and the Child Tax Credit payments would benefit almost eight million or 86 percent of all children in the state. When it was in place, the Child Tax Credit from July to December 2021 paid California families an average of $432 per month.

About Economic Security Project Action: Economic Security Project Action mobilizes resources and people behind ideas that build economic power for all Americans. As an ideas advocacy organization, we legitimize our issues by supporting cutting edge research and elevating champions, win concrete policy victories for the communities that need to see change now, and provoke the conventional wisdom to shift what’s considered possible. Our team of academics, organizers, practitioners and culture makers disburse grants, run issue campaigns, develop creative interventions and research products to support the field, and coordinate events to encourage investment and action from others.